Auto Insurance Quotes: What to Know Before You Buy

One of the easiest ways you find and compare car insurance quotes for free is through a comparison shopping platform like Insurify. Insurify provides you with dozens of personalized quotes from the nation’s leading insurers in just minutes, allowing you to compare purchase policies with ease while saving up to $996 annually.

How to Get Free Car Insurance Quotes

- Getting a quote online. Online comparison shopping offers lots of benefits that in-person or over-the-phone comparison lacks. With Insurify, you only need to put in your personal details once to view a list of car insurance quotes from top companies, and you can seal the deal on an insurance policy at any time of day or night in the comfort of your own home. Check out the best and worst sites to compare auto insurance.

- Visiting an insurance agent in person. If you aren’t a big fan of technology, visiting an insurance agent in person is an easy way to purchase a policy. However, visiting agents in person takes more time than comparing quotes over the phone or online, and your nearest agent may be far away or not available before 9 a.m. or after 5 p.m. Additionally, some agents may sway you into buying insurance from a particular company because they get the best commission from that company, not because it’s a good fit for you.

- Getting a quote over the phone. Most major car insurance companies like GEICO or State Farm will have a phone number you can call to get a free quote. However, these phone lines aren’t always manned 24/7, and repeating details about your driving record or vehicle may get exhausting if you’re comparing quotes from multiple insurers.

Ultimately, comparing car insurance quotes online beats out comparing quotes in person or over the phone, thanks to its convenience, easy access, and unparalleled breadth of choice. And the most-rated and best-rated comprehensive platform for comparing insurance can be found at Insurify. Remember: always compare quotes every six months to score the lowest premiums!

How much should car insurance cost?

The average cost of car insurance in America is $136 a month, according to Insurify’s proprietary database of millions of unique driver quotes. But the cost of car insurance coveragevaries widely from driver to driver.

If you speak to neighbors or friends about their car insurance, you might learn that rates vary due to an excess of factors like age, location, gender, driving history, and the type of vehicle you drive, among others.

Your chosen coverage level matters too: a bare-bones plan with a high deductible will almost always cost less than a robust full coverage policy with add-ons that reimburses you for almost any incident behind the wheel.

Compare Car Insurance Quotes Instantly

- Personalized quotes in 5 minutes or less

- No signup required

Factors That Affect Insurance Rates

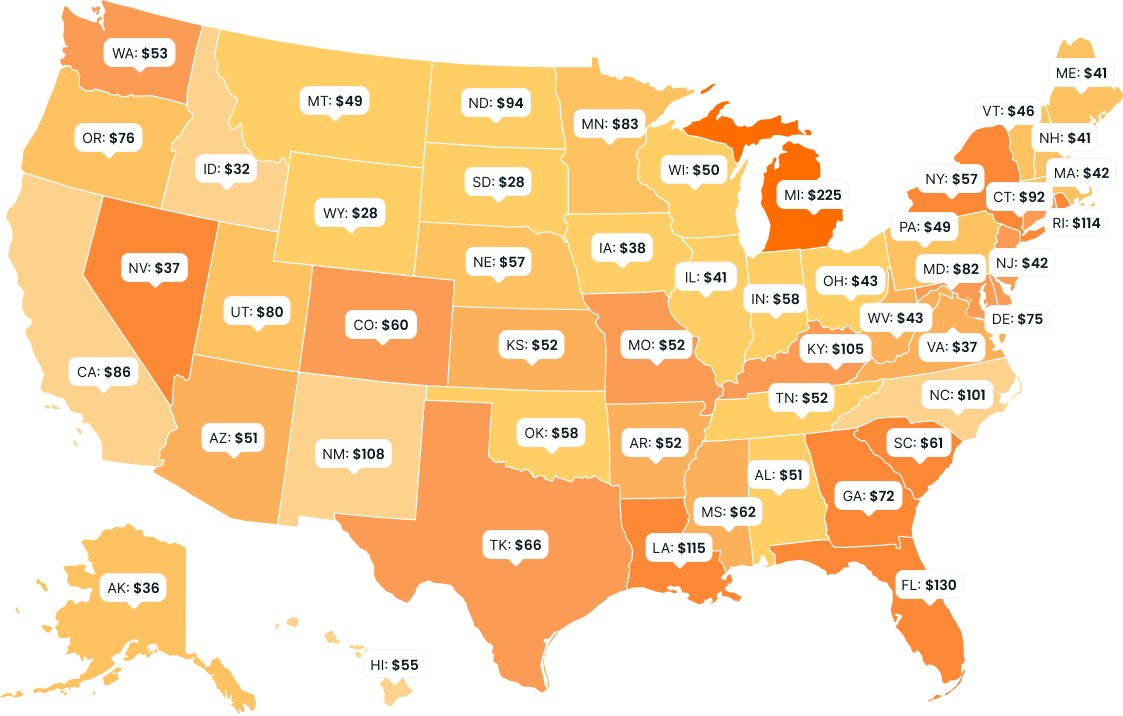

Car Insurance Quotes by Location

The location where you park and drive your car has a large impact on your car insurance rates. This is, in part, due to certain states requiring more robust car insurance coverage with higher limits. According to Insurify’s data, drivers in Michigan pay the highest car insurance premiums in the country, with the average Michigan resident paying $431 a month for car insurance.

Take a look below to see how much the average car insurance policy costs in each state.

In addition to the state in which you live, car insurance companies also take into account the neighborhood and zip code in which you reside. Depending on the average number of car insurance claims filed in your area, car insurance companies may charge you a higher or lower premium. Here are the average monthly rates for the ten most populous states in the US.

- Cheap Car Insurance Quotes in California

- Cheap Car Insurance Quotes in Texas

- Cheap Car Insurance Quotes in Florida

Average monthly rates by state

$127

$144

$155

$177

$220

$239

$282

$297

$316

$431

Who You Are

Car Insurance Quotes by Gender

On average, men pay 9 percent more for car insurance than women do. The difference in insurance premiums is higher for teen drivers and drivers in their early 20s but reduces as drivers get older. This disparity is due to historical data insurers rely on to evaluate risk, which shows that men are more likely to engage in risky driving behavior than women.

Some states, such as California, Hawaii, Massachusetts, Montana, North Carolina, Pennsylvania, have barred insurers from using a driver’s gender while calculating their insurance rates.

Average monthly rates by gender

$216

$238

Car Insurance Quotes by Age

Your age has quite a substantial impact on how much you pay for car insurance, with drivers under 25 paying the most expensive premiums and drivers over 60 paying the least expensive. Insurers use your age to determine your car insurance premium as age is usually an indicator of driving experience and general driving behavior.

Average monthly rates by age

$176

$191

$203

$210

$229

$343

Car Insurance Quotes by Education

Average monthly rates by education

$196

$203

$213

$214

$235

$239

$241

Car Insurance Quotes by Credit Score

Drivers with poor credit scores are considered high-risk drivers and pay up to 15 percent more for car insurance than counterparts with excellent credit scores. Similar to statistics about age, gender, and education level, statistics about credit scores show that drivers with lower credit are more likely to file for expensive claims than those with better credit.

| Credit Score | Average Monthly Premium |

|---|---|

| Excellent | $216 |

| Good | $238 |

| Average | $233 |

| Poor | $224 |

- Car Insurance for Bad Credit Drivers

- Car Insurance With No Credit Check

Car Insurance Quotes by Marital Status

Single people pay slightly higher rates for their auto insurance policy than those who are married. This difference is likely due to the plethora of auto insurance discounts married couples are usually eligible for, like insuring multiple vehicles on one policy and a discount just for being married. On average, married couples pay 7 percent less for coverage than singles.

| Marital Status | Average Monthly Premium |

|---|---|

| Married | $216 |

| Not Married | $232 |

Car Insurance Quotes by Homeownership

| Homeowner Status | Average Monthly Premium |

|---|---|

| Homeowner | $209 |

| Not a Homeowner | $234 |

Your Driving Habits

Car Insurance Quotes Based on How Much You Drive Your Car

On average, Americans who drive less than five thousand miles a year pay nearly 40 percent less than those who drive more than 30 thousand miles a year. Insurers use your annual mileage to calculate your level of risk for one simple reason: the more you drive, the higher your chance of filing a claim due to a car accident or wear and tear. The impact of mileage on your car insurance rate depends on the area in which you live.

| Mileage per Day | Average Monthly Premium |

|---|---|

| 0-5 miles | $177 |

| 6-10 miles | $211 |

| 11-15 miles | $168 |

| 16-20 miles | $229 |

| 21-25 miles | $193 |

| 26-30 miles | $240 |

| more than 30 miles | $246 |

$168

$177

$193

$211

$229

$240

$246

Car Insurance Quotes Based on Your Driving Record

Your driving record is perhaps the most important factor insurers consider while setting your car insurance rates. Drivers with driving violations like an at-fault accident, a suspended driver’s license, or failure to stop for a school bus on their record often have to pay a hefty car insurance premium. Indeed, drivers with a driving violation on record pay up to 30 percent more for car insurance than those with a clean driving record.

| Driving Violation Type | Average Monthly Premium | Impact of Violation |

|---|---|---|

| No Prior Violation | $206 | N/A |

| Not-at-fault accident | $260 | 26.21% |

| Failure to stop at a red light | $266 | 29.13% |

| Negligent driving | $276 | 33.98% |

| At-fault accident | $279 | 35.44% |

| Careless Driving | $297 | 44.17% |

| Failure to stop for a school bus | $305 | 48.06% |

$206

$260 +26.21%

$266 +29.13%

$276 +33.98%

$279 +35.44%

$297 +44.17%

$305 +48.06%

Your Car

Car Insurance Quotes Based on The Age of Your Car

The age of your car is an important factor insurers consider when setting your car insurance rates because newer cars have more expensive parts that are costly to replace in the event of a claim. However, if your car is older than 30 years, your premium will also be on the more expensive side since parts for those cars can be difficult to replace. Take a look below to see how the age of your car impacts your car insurance rate.

How much does vehicle’s age impact insurance costs?

$138

$141

$154

$181

$215

$270

$300

Car Insurance Quotes Based on The Type and Make of Your Car

The make, model, and type of car you drive has a major impact on your car insurance rate. Usually cars with a high retail value, cars made by foreign manufacturers, and cars built for faster driving are more expensive to insure because their parts are harder and costlier to replace.

| Car Type | Average Monthly Premium |

|---|---|

| Coupe (2-door) | $272 |

| Sedan (4-door) | $262 |

| Convertible | $237 |

| Hatchback | $229 |

| Sport Utility Vehicle | $228 |

| Sport Utility Truck | $189 |

| Pickup | $187 |

| Truck (Both Sport Utility and Pickup) | $187 |

| Passenger Van | $156 |

| Cargo Van | $149 |

Car Insurance Quotes Based on Your Insurance History

Average monthly rates by insurance state

$222

$237

Car Insurance Quotes Based on Your Coverage Level

State Minimum Car Insurance

Most states require drivers to purchase a car insurance policy that includes some form of bodily injury and property damage liability insurance. However, some states require additional auto insurance coverages, such as uninsured and underinsured motorist coverage and personal injury protection.

Some drivers may choose to supplement their state minimum car insurance coverage with helpful add-ons like roadside assistance, accident forgiveness, or medical payments coverage. The more coverage options you choose and the higher the limits you pick for those options, the more expensive your car insurance policy is.

Liability Car Insurance Quotes

Since bodily injury and property damage liability insurance is required in most states, some drivers may purchase state minimum liability insurance to save money, though that’s not always advisable. The average cost of a liability-only car insurance policy is $160, but based on the laws in your state, prices vary. Check out the cheapest liability-only policies in your state.

Which type of car insurance has the lowest rates?

| State | Insurance company | Monthly rate |

|---|---|---|

| Alabama | Progressive | $67 |

| Alaska | Midvale Home & Auto | $110 |

| Arizona | Foremost Signature | $86 |

| Arkansas | Progressive | $68 |

| California | Freedom National | $76 |

| Colorado | Sun Coast | $79 |

| Connecticut | Progressive | $130 |

| Delaware | Midvale Home & Auto | $176 |

| Florida | AssuranceAmerica | $144 |

| Georgia | Progressive | $108 |

Full Coverage Car Insurance Quotes

A full-coverage car insurance policy consists of collision and comprehensive coverage in addition to the required liability insurance. Collision coverage pays for property damage to your car in the event that it collides with another vehicle or object, while comprehensive coverage covers damage to your car in the event of theft, vandalism, Acts of God, and so on.

| State | Insurance company | Monthly rate |

|---|---|---|

| Alabama | Progressive | $135 |

| Alaska | Midvale Home & Auto | $179 |

| Arizona | Mile Auto | $128 |

| Arkansas | Progressive | $168 |

| California | Travelers | $155 |

| Colorado | Bristol West | $198 |

| Connecticut | Progressive | $191 |

| Delaware | Midvale Home & Auto | $236 |

| Florida | AssuranceAmerica | $203 |

| Georgia | Progressive | $186 |

Home and Car Insurance Quotes

However, bundling your home and car insurance doesn’t guarantee the cheapest quote. Even after applying discounts, another insurer might offer a lower price for individual home or auto policies, and some low-cost insurers like Metromile and Clearcover offer car insurance exclusively. That’s why it’s smart to use a comparison site like Insurify before bundling.

How to Find Cheap Car Insurance Quotes

Other than shopping around every six months, the best and easiest way to get cheap car insurance quotes is by using a quote-comparison site like Insurify, which automatically compares quotes from dozens of different insurers to find the perfect policy for you.

One of the other ways to save on car insurance quotes is to negotiate with your current insurer. Your insurer won’t want to lose a paying customer, so if you’ve found more affordable car insurance elsewhere and let them know, they may agree to match that price or offer a discount. A few other simple tips and tricks to get the cheapest car insurance quotes include:

- Installing an anti-theft or telematics device

- Taking a defensive driving course

- Raising your credit score or GPA

- Driving a safe, low-risk vehicle like a minivan

Many insurance companies also offer car insurance discounts for certain professional groups or categories of drivers. Popular discounts include the good driver discount for drivers with a clean driving record, the good student discount for young drivers who have a good GPA in high school and college, and the electric car discount for eco-friendly drivers.

Best Car Insurance Quotes by State

For each state, different carriers will, on average, provide the best car insurance quotes. According to Insurify data, here are the best quotes you can expect in each of the 50 states.

| State | Insurance company | Monthly rate |

|---|---|---|

| Alabama | Travelers | $128 |

| Alaska | Midvale Home & Auto | $164 |

| Arizona | Clearcover | $118 |

| Arkansas | Safeco | $152 |

| California | Travelers | $143 |

| Colorado | Bristol West | $164 |

| Connecticut | Safeco | $196 |

| Delaware | Midvale Home & Auto | $220 |

| Florida | Bristol West | $226 |

| Georgia | Travelers | $182 |

Compare Quotes Online Instantly

Compare car insurance quotes in minutes by using Insurify. It’s easy to get overwhelmed by finding an auto insurance quote. Insurify does all the hard work to find the perfect quote for you, using cutting-edge AI tech to prepare quotes custom-fit for your unique needs. With a 4.8 overall customer satisfaction rating based on over 3,200 customer reviews, Insurify is the most highly-rated and best-rated insurance comparison site in America.

Insurify is partnered with leading insurers like Nationwide and Liberty Mutual so customers can compare and purchase dozens of different car and home insurance quotes in just minutes and save up to $996 annually. Most importantly, Insurify is always free to use and never sends spam calls or texts to users who don’t request them. Try Insurify today to see the difference.

What our customers say

Based on 3000+ reviews and 26M+ quotes.

Insurify made my car insurance experience smooth. And the prices were better than what I was already paying

Antonique D.

Insurify provided a one-stop-shop for home insurance quotes to cover my new home in a new state. Saved me hours of research and comparison. Absolute no brainer, Insurify is great!

Nick L.

Simple questions to get through my quote. I like the fact that I could decide if someone called me before proceeding or if I wanted to do it all online. Having the choice is nice.

Mariah N.

Read more reviews (3000+)

Auto Insurance Trends

Projected annual car insurance rates in 2023

*Based on projections modeled from historical premium trends from Insurify’s proprietary database.

Insurance costs are on the rise, too. The average American is expected to spend $1,649 on car insurance in 2022. As coverage costs continue to climb with no signs of subsiding, American drivers are likely to pay an additional 12%* for insurance in 2023, spending $1,846 on their premiums.

Various factors have contributed to the rise in car insurance costs over the past year, including nationwide inflation and trends in driving violations. Since the pandemic, heightened rates of accidents and dangerous driving across the country have resulted in higher payouts from insurance providers, in turn ratcheting up premium costs.

If you have any questions or comments about this report, please contact [email protected].